Contents:

The bulls, however, could not maintain the price move higher, as sellers came in and overwhelm the buyers with their supply-side orders. This leads to a sharp move lower as the sellers are the ones that are truly in control of the market during this time. This is often referred to as a shadow or a price rejection to the upside.

We’re also a community of traders that support each other on our daily trading journey. The longer the upper shadow, the higher the potential for a reversal. I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets.

Because buyers could not keep on pushing the shooting star forex up, they had ended up against the sellers. The shooting star pattern can occur during periods when bulls appear to be in total control, with prices likely to continue edging higher. When the shooting star occurs, it first rises, implying the buying pressure experienced during the previous session is still in play. However, as the session or day progresses, short sellers enter the fray piling the pressure on the bulls.

What is the Shooting Star Candlestick Pattern?

No, the shooting star pattern indicates only a bearish trend, but can also form in an uptrend. First, it is important to determine the top of the instrument, as a shooting star forms on it. If the pattern occurs in an uptrend, wait for a trend reversal and a breakout of the lower border of the uptrend.

- 75% of retail client accounts lose money when trading CFDs, with this investment provider.

- In this post, you’ll learn about the shooting star candlestick pattern’s structure, significance, trading psychology, and trading guide.

- This is because the pattern can take quite a bit of time to develop before any significant price moves begin.

- The shooting star candle is most effective when it forms after a series of three or more consecutive rising candles with higher highs.

- At one point, there is a new high in place, above the horizontal resistance.

You can see that confirmation bar noted as Entry on the price chart above. We will place a market order to sell immediately following the close of that candle. The stop loss on the trade will be set at the high of the price bar that breaks below the trendline. Essentially, that is the bar that acts as our entry confirmation signal. Finally, we will need a way to monitor the price action if it moves in our favor to the downside, and exit the trade when the weight of evidence is pointing to an upside reversal.

Can a shooting star candlestick be green?

After technical analysis and opening a short trade, it is important to set a Stop-loss. According to risk management rules, stop-loss must be set above the broken out support level or 500 basis points above the position opening. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

- The upper tail, also known as a “shadow,” which is the line that forms above the body of the candlestick, is at least two to three times longer than the candlestick body.

- The shooting star pattern must still occur after a price move higher, however in this case, that price rise should be a correction to the larger downtrend.

- Good strategies generally combine candlestick patterns with other forms of technical analysis to help traders make better-informed trading decisions.

- So now we have protected the position in case the trade begins to move against us.

HowTohttps://g-markets.net/.com helps traders of all levels learn how to trade the financial markets. When the RSI rises above 70, then the market is essentially in overbought mode and a bearish trend reversal is expected. When the RSI falls below 30, then the market is in an oversold condition and a bullish trend reversal is likely to happen.

Step-by-Step Guide to Trade the Rounding Bottom Pattern

For example, if you think that a shooting star at the top of an uptrend means possible reversal, you can test the bearish bias using Fibonacci retracement. This indicator can pinpoint the degree to which a market will move against its current trend. Firstly, we can see within the magnified area near the top right of this image, a clearly defined forex shooting star candlestick. Remember, a valid shooting star candle pattern should meet a few important guidelines. Firstly, the upper wick within the shooting star should be quite noticeable and prominent in relation to the lower wick or shadow of the candle. First of all, you open the chart and try to find a shooting star.

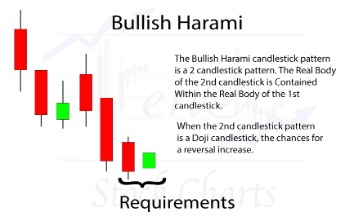

The next candlestick goes below the low of the shooting star, confirming the pattern. The long upper tail of a shooting star shows that bulls were trying to push the price higher, but by the end of the session more bears appeared, and they pulled the price lower. In other words, higher prices were rejected, so the price moved down. That’s why the price is likely to go down in the next session as well. Chart patterns Understand how to read the charts like a pro trader.

How To Spot Resistance With Shooting Star Patterns

The shooting star is one of the key patterns in candlestick analysis. Trading this candlestick allows traders to make money during short-term trading. We will plot a bearish channel by connecting the most prominent swing highs within the downtrend, and then run a parallel of that line off of the lower swing points.

Place stop loss level a few pips above the high of shooting star candlestick for high-risk entry with a large risk-reward ratio. However, if you want to go with a conservative trade setup, always place a stop loss above the resistance zone instead of placing a stop loss just above the high. Like any other candlestick pattern, the shooting star pattern cannot be used in isolation to make a trading decision. The pattern does not provide accurate insights for trading price reversals on its own.

The pattern shows prices opened and went higher but closed lower at the end of the day resulting in a long wick and small body. The emergence of a bearish candlestick the following day affirms that momentum had changed from bullish to bearish on bears overpowering the bulls. Furthermore, experienced traders always look out for confluence. Confluence describes the event of multiple indicators pointing in the same direction. Therefore, we will always search for multiple confirmations, e.g. one could only sell a shooting star candlestick formation if the price reaches a resistance area at the same time. Also, it is very important to wait for the candlestick to be formed and not to sell a shooting star candlestick formation as long as the candlestick wasn’t closed yet.

Let’s now take a moment to dissect the anatomy of a shooting star formation. For example, waiting a day to see if prices continued falling or other chart indications such as a break of an upward trendline. This is especially the case when the wick of a shooting star is also the new short-term high.

This can lead to a higher rate of false signals, and lower overall profitability when using the pattern. Those that do take the time to understand the market environment in which the shooting star pattern should be traded, will be better rewarded for their efforts. With these conditions met, we should go back to the shooting star formation for further analysis. We want the shooting star pattern to have either touched or penetrated the upper line of the bearish channel. If you look closely at the shooting star formation once again, you will notice that the upper wick did in fact penetrate the upper line of the bearish channel plotted.

On the other hand, you can go for a detailed combination of channels, volatility, and candlesticks. Price action trading strategies focus on the movements of the market based on previous price fluctuations. With the obtained information, a trader is able to make subjective decisions on the direction of the asset.

Shooting Star: What It Means in Stock Trading, With an Example – Investopedia

Shooting Star: What It Means in Stock Trading, With an Example.

Posted: Sat, 25 Mar 2017 19:31:54 GMT [source]

The next candle must gap lower and move lower on heavy volume to confirm a change of momentum from bullish to bearish. It is important to acknowledge that one candle is often not meaningful enough to estimate the chances of a potential reversal. First and foremost, the timeframe is a very important factor for the significance of candlestick analysis. The higher the timeframe, the more significant is the candlestick pattern.