If a company is paying invoices in 20 days and the industry is paying them in 45 days, the company is at a disadvantage because it’s not able to use its cash as long as the other companies in its industry. It may want to lengthen its payment periods to improve its cash flow as long as this doesn’t mean losing an early payment discount or hurting a vendor relationship. For example, let’s assume Company A purchases raw material, utilities, and services from its vendors on credit to manufacture a product.

- A very short or long days payable outstanding can be bad for business.

- This means that the company can use the resources from its vendor and keep its cash for 30 days.

- But the reason some companies can extend their payables whereas others cannot is tied to the concept of buyer power, as referenced earlier.

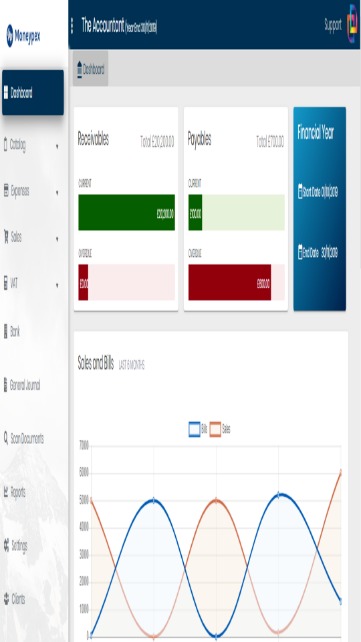

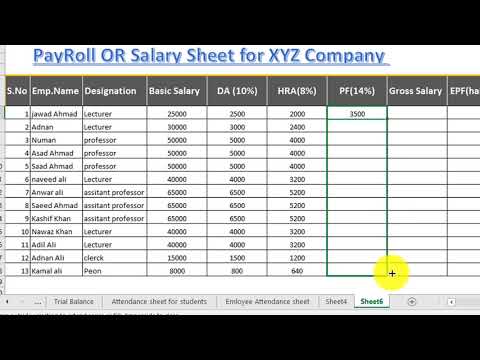

Accounting software like QuickBooks Online can quickly generate the reports you need to calculate DPO. If you’re still using Microsoft Word or Excel for your bookkeeping, we recommend you upgrade to QuickBooks. However, a forecast driven off DPO would likely be viewed with more credibility compared to the % of revenue forecasting approach.

Best practices for managing your Days Payable Outstanding

DPO provides a helpful view of cash liquidity, financial health, and other metrics like average inventory and annual revenue. Days payable outstanding (DPO) states the average number of days that it takes for a business to sales tax calculator pay its accounts payable. A high result is generally considered to represent good cash management, since a business is holding onto its cash for as long as possible, thereby decreasing its investment in working capital.

While bills must eventually be paid, for now, the company is free to use that cash for other needs. On the balance sheet, the accounts payable (AP) line item represents the accumulated balance of unmet payments for past purchases made by the company. The good or service has been delivered to the company as part of the transaction agreement, but the company has yet to pay. Though revenue is your main priority, you also need to step back and check your finances periodically. Your DPO can help you plan spending, forecast cash flow, and review payment terms.

Conclusion: track your cash conversion cycle in Cube

Days Payable Outstanding, often abbreviated as DPO, is a financial metric that shows how long, on average, it takes for a company to pay its invoices from trade creditors, such as suppliers. In simpler terms, it measures the average number of days a company takes to pay its bills. This indicator gives us insights into a company’s management of payables and cash flow.

Supply Chain News: Understanding Days Payables Outstanding … – Supply Chain Digest

Supply Chain News: Understanding Days Payables Outstanding ….

Posted: Tue, 19 Sep 2017 07:00:00 GMT [source]

Understanding why your business takes a certain amount of time to pay its bills and invoices, whether to vendors, suppliers, or other companies, can tell you a significant amount. That’s why it’s a good idea to have a solid understanding of days payable outstanding ratios. Days Payable Outstanding (DPO) is a financial metric that measures the amount of time it takes for a company to pay its suppliers for goods and services received. DPO is an important performance indicator that allows businesses to better manage their cash flow and vendor relationships. In this article, we’ll take a deep dive into what DPO is, how to calculate it, and strategies for optimizing it.

How Does DPO Impact Cash Flow?

While DPO values are often specific to individual businesses, its general tracking as a finance metric is commonly used to make businesses more strategic and less reactive. Sum all purchases of inventory—whether paid with cash or credit—for the period. If you use QuickBooks Online, you can run a vendor purchases report and select only the suppliers from which you buy inventory. Check out our list of the best small business accounting software to explore more solutions. Days Payable Outstanding (DPO) measures how quickly a company pays its bills to suppliers and vendors.

- If you want to increase DPO, it can be a good idea to rework your invoicing process.

- Investors and analysts use DPO to measure a company’s liquidity and credit risk.

- They can be calculated for any time period, but most often on a 365-day basis.

- This can be advantageous, as it allows for greater liquidity and the opportunity to use that cash for other operational needs or investments.

- While bills must eventually be paid, for now, the company is free to use that cash for other needs.

Shorter DPO means you aren’t holding onto your cash, but also that you may be securing early payment discounts. Longer DPO can mean you end up paying late fees and compromising vendor relationships. Optimizing DPO is the balance of holding onto your cash as long as possible without negatively impacting vendor relationships or incurring penalties. Some may track DPO with the goal of shortening it so that they can capture early payment discounts and promote strong vendor relationships.

How to Calculate Days Payable Outstanding (DPO)?

It might be beneficial for a company to compare its DPO with the average DPO in its industry. Optimization of Accounts Payable (AP) is very important if a business wants to increase its DPO ratio. It can free up working capital to drive business growth, enhance corporate cost control, and minimize the complexity of the AP process by taking a strategic approach. It’s important to keep all of these things in mind when analyzing the days outstanding payable ratio. Just as the speed of life differs between a bustling city and a tranquil village, DPO varies significantly between industries. Factors such as payment terms, business models, and industry practices all contribute to this variation.

Too low a value indicates you may be paying suppliers sooner than necessary, whereas too high a value indicates you may have cash flow problems. The optimal value should be slightly less than the standard payment terms given by your suppliers. Adjusting DPO is as much about when you pay and how long you take to pay. Paying invoices after the close of an accounting period increases the average accounts payable balance to decrease the DPO metric. Days Payable Outstanding (DPO) measures the number of days a company takes on average before paying outstanding supplier/vendor invoices for purchases made on credit. A very short or long days payable outstanding can be bad for business.

Days payable outstanding (DPO) is a liquidity metric that measures how long a company takes to pay its suppliers. It is calculated by dividing the total amount of payable by the average daily cost of goods sold. A higher DPO indicates that a company is taking longer to pay its suppliers, which could be a sign of financial distress. Investors and analysts use DPO to measure a company’s liquidity and credit risk.

If a retail company has a DPO of 45 days, it might seem reasonable when compared with manufacturing. However, this figure is considerably higher than the retail industry average, suggesting this retail company takes a longer time to pay suppliers compared to its industry peers. Accounts payable turnover ratio also helps finance teams evaluate how quickly suppliers are being paid, but the calculation and units of measurement are different. This formula generally showcases how often vendors are being paid in a given amount of time. Initially the company was very reactive with their invoices–paying each invoice the day it was received. There was no consideration about how to prioritize payments, or the potential benefits of holding onto cash, instead the team was solely focused on processing invoices to get them off their plate.

Days Payable Outstanding (DPO) is just one of several key financial metrics that businesses use to monitor their financial health. Other important metrics include Days Sales Outstanding (DSO), Inventory Turnover, and Gross Margin. Theoretically, a DPO close to your typical payment terms is generally best. If your vendors typically give you 30 days to pay, then your DPO should be just under 30 days. However, another useful measure is to compare your DPO with industry averages. For example, if you are measuring the number of days it takes to pay a vendor in a month, your number of days would be 30.

How to Use DCF (Discounted Cash Flow Model) for Valuation – The Motley Fool

How to Use DCF (Discounted Cash Flow Model) for Valuation.

Posted: Tue, 08 Aug 2023 21:54:48 GMT [source]

Exceeding your payment terms with vendors may cause them to suspend service or place limits and fees on your accounts. Low DSO is a desirable metric, so long as you’re not rushing vendor payments at the expense of optimizing growth. With cash in hand, the company can invest in its growth and improve its market position.

In some cases, you may even need vendors to serve as a reference for a new supplier you are trying to bring on. Additionally, today’s strained supply chains make it harder for businesses to receive the materials they need. A low DPO can help ensure that vendors will prioritize your company’s orders, amidst a market with dwindling resources. Several companies have successfully implemented DPO strategies to optimize cash flow and improve financial performance.

In addition, analyzing the trends in your DPO over time, alongside industry averages, can indicate the effectiveness of changes in your payment policies or cash management strategies. This makes DPO not just a snapshot of your current situation, but a tool for monitoring progress and driving improvements. Therefore, comparing your company’s DPO with the industry average provides a more accurate picture of your payment practices. It allows you to benchmark your company against others in the same sector, providing insights into your relative performance and offering a clearer understanding of your cash management efficiency. A first glance might lead you to think QuickPay Corp is more efficient because it pays faster.